Table of Contents

- 2024 Tax Brackets Australia Ato - Hatty Kordula

- 2024 Australian Tax Bracket Changes - Cosca

- 2024 Australian Tax Bracket Changes - Cosca

- Income Tax Rates Australia 2024 - 2024 Company Salaries

- Understanding the Australian tax system 2025

- 2024 2025 Tax Rates Australia - Fey CarolJean

- Tax Brackets Australia 2024-2025 | Pherrus Financial

- Australian Income Tax Rates 2024-25 - Rafa Ursola

- Tax Rates 2024-25 Ato - Jolie Madelyn

- Are You Aware of the New Australian Tax Rates 2024?

Tax Residency in Australia

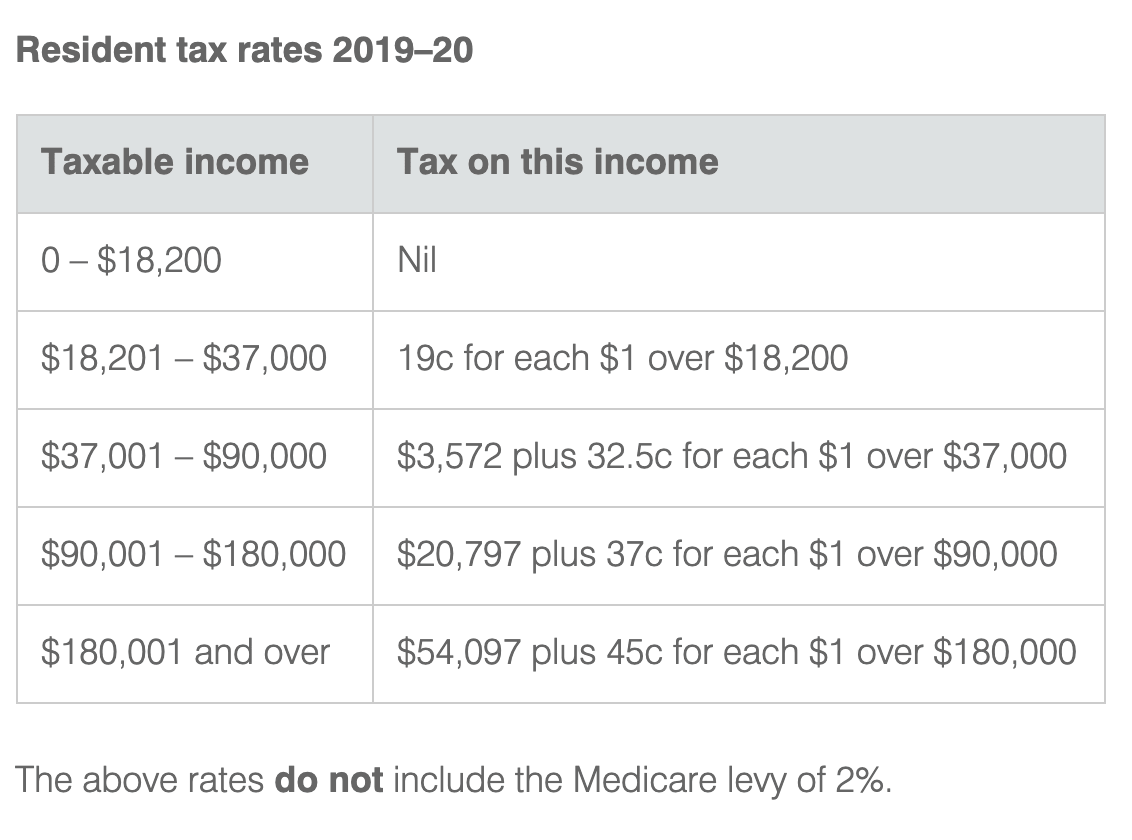

Tax Rates for Australian Residents

How Tax Rates Work

To calculate your tax liability, you need to work out your taxable income and then apply the tax rates to that income. For example, if you earn $60,000 per year, your tax liability would be: 0 - $18,201: 0% tax rate = $0 $18,201 - $37,000: 19% tax rate = $3,543.99 $37,001 - $60,000: 32.5% tax rate = $7,412.50 Your total tax liability would be $10,956.49.

Claiming Tax Deductions

As an Australian resident, you may be eligible to claim tax deductions on certain expenses, such as work-related expenses, charitable donations, and medical expenses. The ATO allows you to claim deductions on expenses that are directly related to earning your income. You can claim these deductions on your tax return, which will reduce your taxable income and lower your tax liability. Understanding tax rates as an Australian resident is crucial to managing your finances effectively. The ATO provides guidance on tax rates and regulations, and it is essential to stay informed about any changes to tax laws and regulations. By knowing your tax rates and claiming eligible deductions, you can minimize your tax liability and keep more of your hard-earned income. If you are unsure about your tax rates or have questions about claiming deductions, it is always best to consult with a tax professional or contact the ATO directly.For more information on tax rates and regulations, visit the Australian Taxation Office website. Stay up-to-date with the latest tax news and updates to ensure you are meeting your tax obligations as an Australian resident.